ABOUT AUSTIN CAPITAL BANK

Our Story

We view community differently. Where other banks define it by zip codes, we see people and businesses united by shared challenges and experiences that require focused solutions. When consumers were caught in the credit paradox, we created Credit Strong as a path for them to demonstrate responsible financial behavior and build credit on their own terms. When we saw the urgent need for parents to protect their children’s identities, we developed FreeKick. Now, as rampant fraud targets everyone’s financial security through increasingly sophisticated attacks, we’ve built Fort Knox—a revolutionary banking platform purpose-built to prioritize security for our account holders at every level.

To tackle these challenges, we’ve built something else unique in community banking: a team that combines banking expertise with state-of-the-art technological innovation. Our leadership includes bank founders and former advisors to the Federal Reserve and Consumer Financial Protection Bureau working alongside veterans of some of the most successful fintech ventures of the last decade. Our engineering team—over 50 strong and growing—designs and builds custom solutions from the ground up. Rather than relying on outdated banking cores and legacy technologies that have been entrenched in financial services for decades, we harness state-of-the-art innovation and best-of-breed third-party solutions to challenge banking’s most flawed assumptions and outdated practices.

This combination of banking expertise, deep regulatory insight, technological capability and innovative spirit allows us to solve problems other banks can’t—or won’t.

This is about more than building products. It’s about fundamentally reimagining how banks protect and serve their customers. And with every innovation, from credit building to fraud prevention, we’re writing new chapters in our story of serving communities, wherever they are.

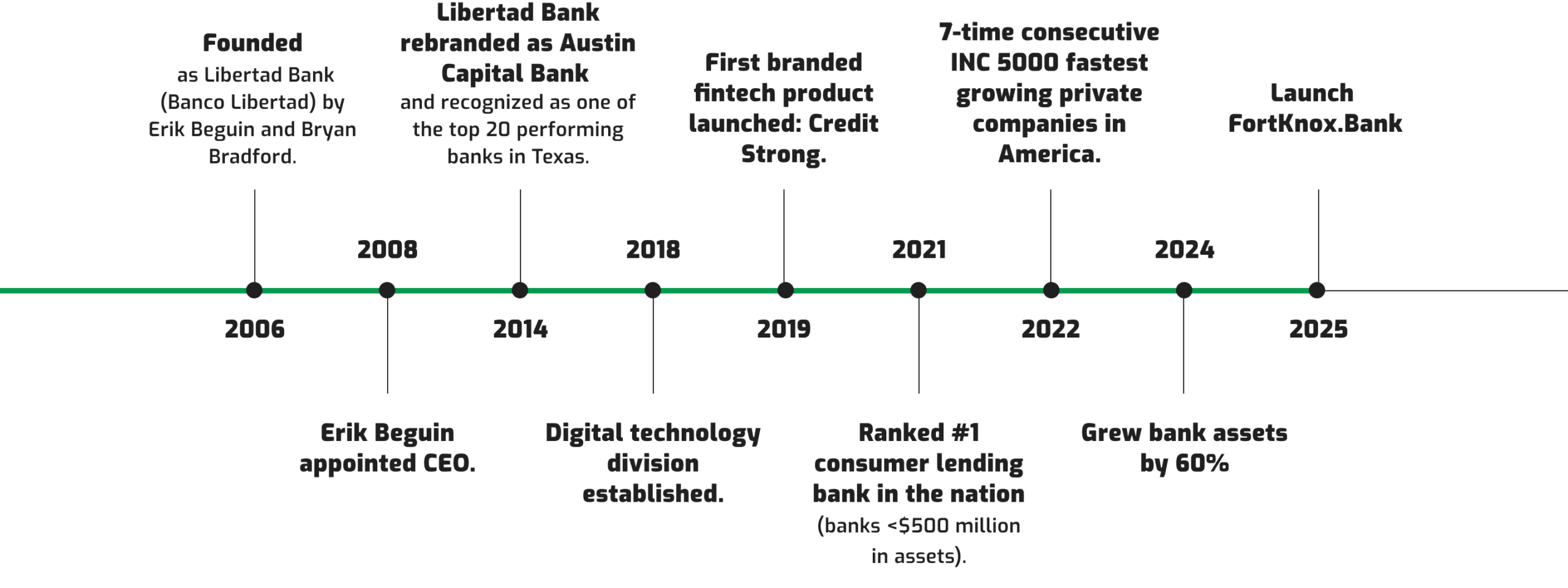

TECHNOLOGY DRIVEN AND GROWING FAST.

Recognized as one of the fastest-growing private companies in the U.S.

Erik Beguin CEO

Our CEO, Erik Beguin, is a nationally recognized leader in the banking industry with extensive experience in financial management, counseling, and leadership. In addition to founding our de novo bank, he has been an authority in brand management and consulting roles while significantly contributing to shaping the future of banking.

Nationally Recognized CEO

Key Accomplishments:

- Two-time federal appointee to the Consumer Financial Protection Bureau Community Bank Advisory Council

- Two-term member of the Community Depository Institution Advisory Council for the Federal Reserve System’s Board of Governors.

- Chairman of the Community Depository Institution Advisory Council for the Federal Reserve Bank of Dallas (5 years).

- Contributor to the Texas Banker Association’s Future of Banking Taskforce.

- Founder of Austin Capital Bank.

- Former leader at Works, Inc., acquired by Bank of America.

- Brand management experience at Procter & Gamble.

- Management consulting and CPA work at KPMG.

Bank Leadership Team.

We are one of the most rapidly growing companies in the nation, repeatedly receiving recognition on the list of INC 5000 fastest-growing private companies in America.

Austin Capital Bank is an Equal Opportunity Employer. We do not discriminate based on race, color, religion, sex, national origin, age, disability, veteran status, genetic information, or any other protected characteristic under applicable law.

Careers

Austin Capital Bank is a 5-star rated independent Austin, Texas community bank and member of the Federal Deposit Insurance Corporation (FDIC).

At our core, we are entrepreneurs and innovators with an intense focus on exceptional customer value and experience. Leveraging the bank’s proprietary technology, we’re growing quickly and expanding into new digital markets and product categories at a rapid pace.

With all this opportunity and growth, we need exceptional individuals to join our fintech and banking team!